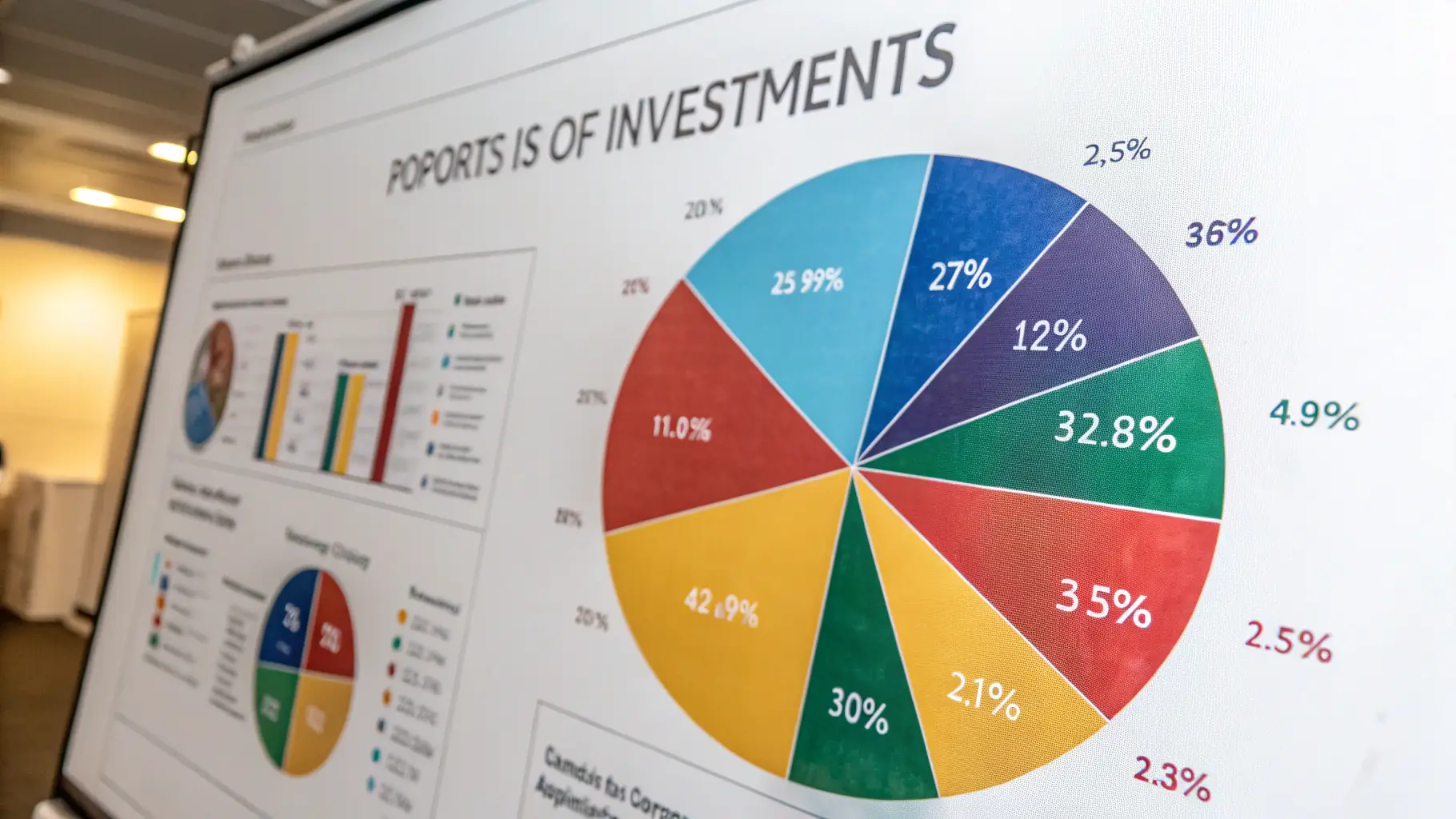

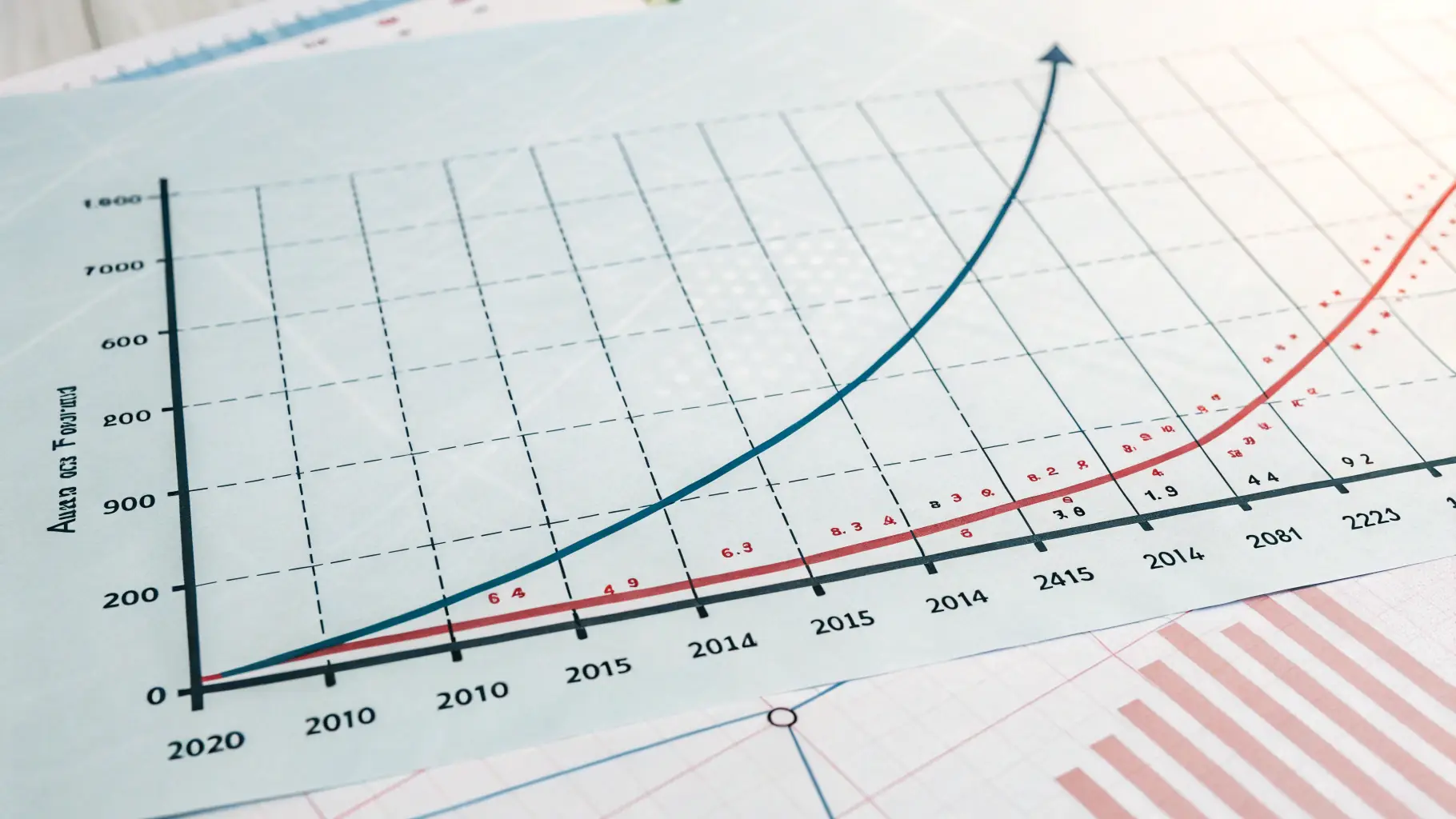

Economic conditions are constantly evolving, impacting investment strategies. A dynamic approach is essential for navigating these changes and maximizing returns. Strategic planning is key to capitalizing on opportunities and mitigating risks. Understanding market trends is vital for informed decision-making. Diversification of assets is a cornerstone of robust investment portfolios. By spreading investments across various sectors, investors can reduce risk and potentially enhance returns. Careful consideration of asset allocation is crucial for long-term financial success. A well-structured portfolio can weather market volatility and contribute to sustained financial growth. Staying informed about economic indicators and market trends is paramount for successful investment strategies. Monitoring key economic data allows investors to adapt their strategies in response to changing conditions. This proactive approach can help investors capitalize on opportunities and mitigate potential risks. Regular review and adjustments are essential for optimizing investment performance.

Economic Planning: Navigating Uncertain Times

Economic planning is crucial for businesses to adapt to changing economic conditions.