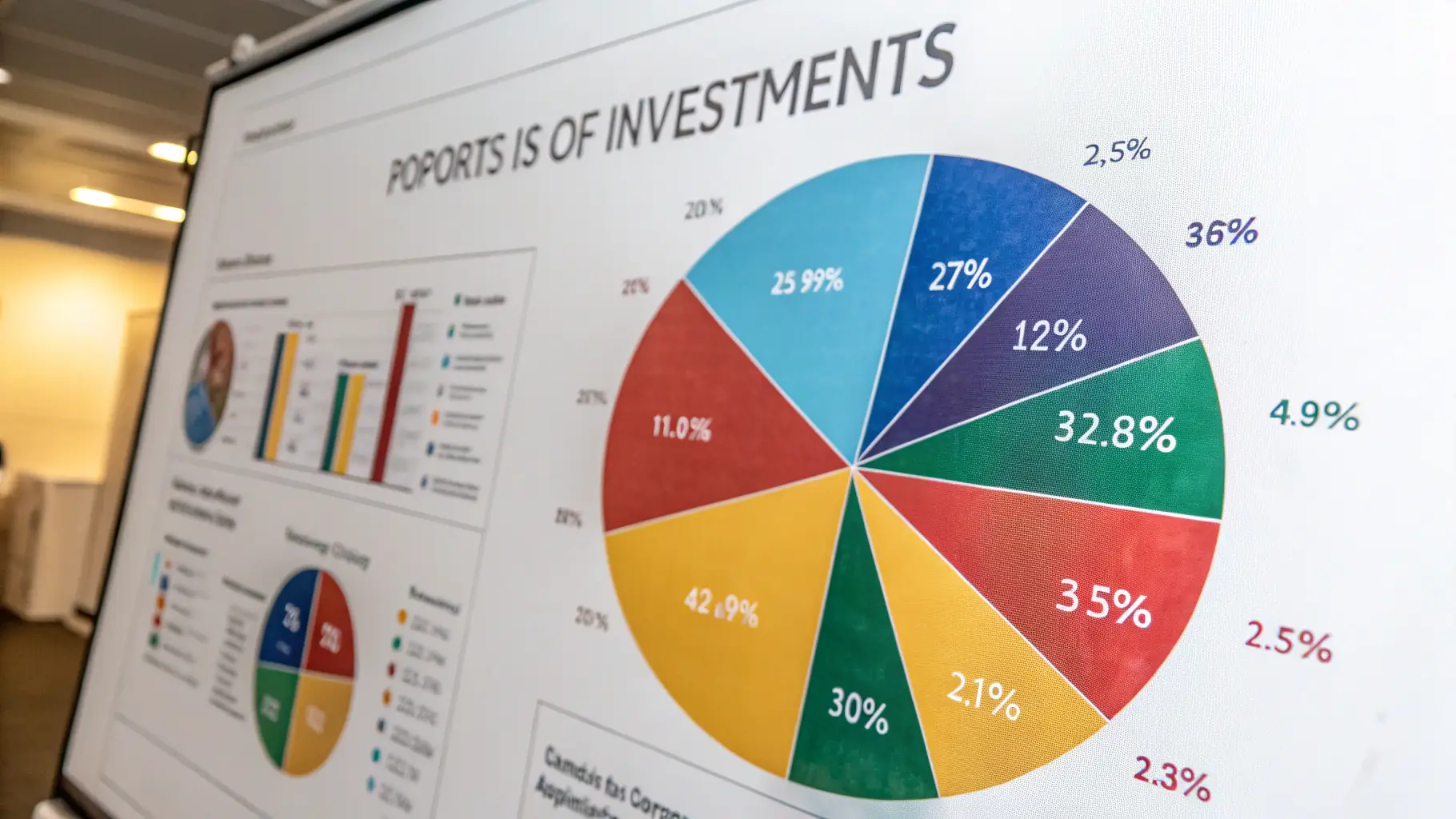

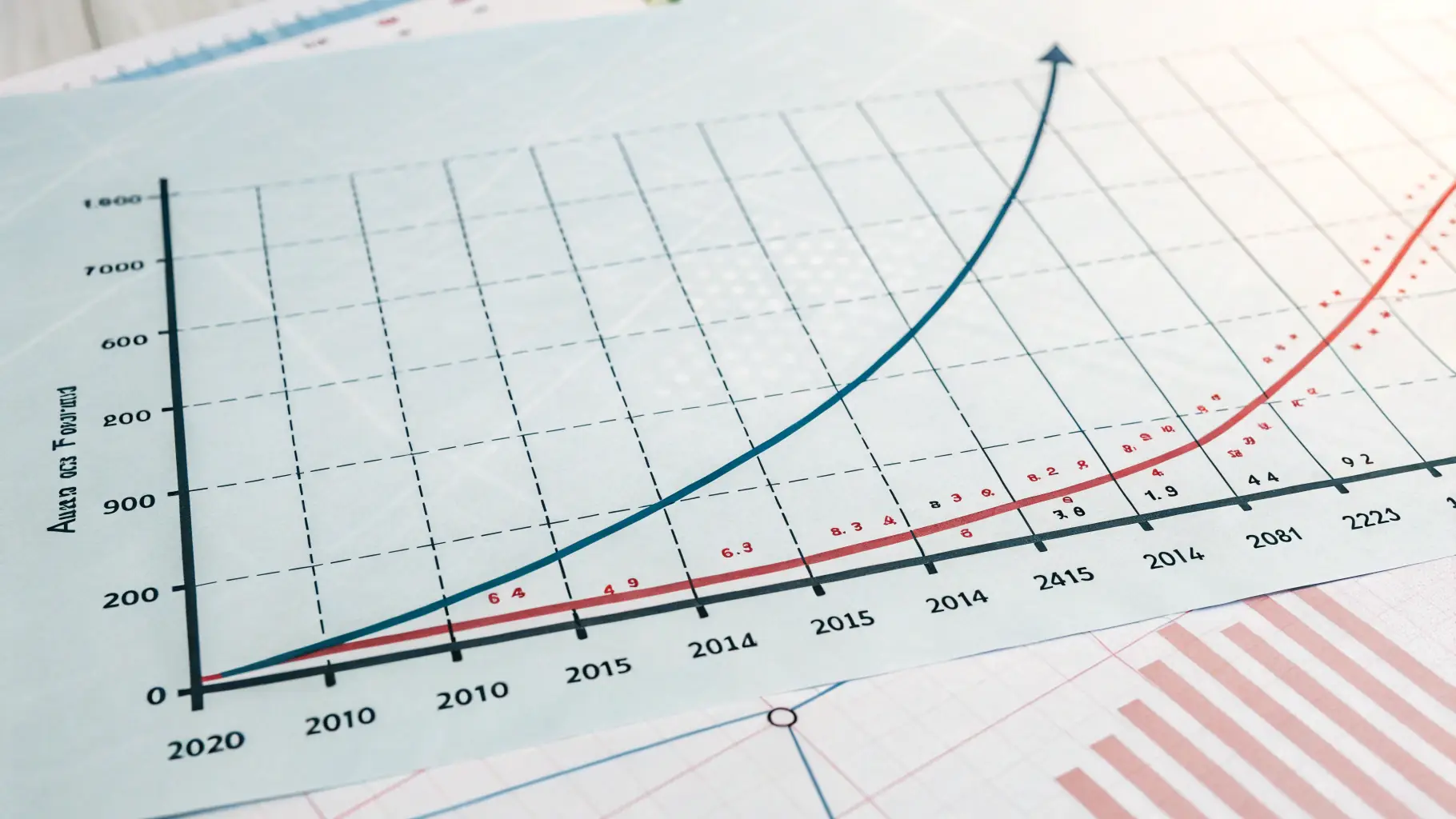

Capital allocation is a critical aspect of investment management. A well-defined strategy can help you achieve your financial goals and maximize returns. Understanding your investment objectives is the first step in developing an effective capital allocation strategy. Careful consideration of risk tolerance and investment horizon is essential. Diversification is a key principle in capital allocation. By spreading your investments across different asset classes, you can reduce risk and potentially enhance returns. A diversified portfolio can help you weather market fluctuations and achieve long-term financial success. Understanding the correlation between different assets is crucial. Regular review and adjustments to your capital allocation strategy are essential for optimal performance. Monitoring market trends and economic indicators allows you to adapt your strategy in response to changing conditions. This proactive approach can help you capitalize on opportunities and mitigate potential risks. Seeking professional advice can provide valuable insights and support.

Economic Planning: Navigating Uncertain Times

Economic planning is crucial for businesses to adapt to changing economic conditions.